How you set your membership fees is directly related to how successful your practice will be.

Unfortunately, many DPC and concierge physicians are moonlighting to keep their businesses afloat. Not for just a few shaky initial months, but several years after converting or starting up the new practice. These doctors were intending to escape overwork and burnout, yet this scenario threatens to perpetuate the very problems they were trying to get away from. Instead of having a viable business, the extra job is the main source of income, and the DPC practice the unintended “hobby”.

Why does this happen?

Usually it’s a combination of factors – not anticipating how long or how challenging it can be to get enough patients, not understanding the whole financial picture and planning accordingly, not containing expenses enough, not investing in essential marketing, and deciding on fees that are too low (or high) to sustain the practice.

Let’s look at just one of these important factors – setting membership fees. How do you determine the necessary balance between your pricing structure and the number of patients needed to cover expenses, pay your salary… and stay in business?

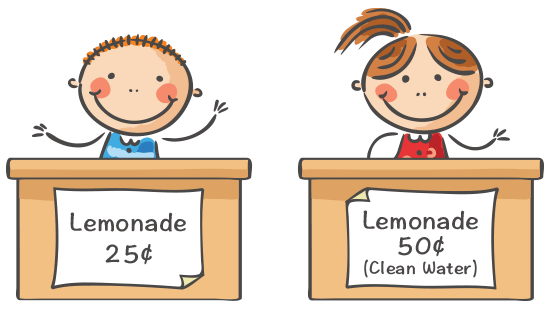

Generally speaking, when price increases, demand tends to go down. The higher the membership fee, the fewer buyers you’ll probably get. Setting a lower fee however, may also work against you because you’d need that many more buyers to offset the lower fees, and it can be difficult to attract such a high volume. In addition, you might not want an excessive number of patients in your new practice. So, there is an optimal pricing level to reach, and this is the sweet spot to be found.

Here are the main methods for setting DPC or concierge membership fees:

1. Cost-based pricing

With this method, you calculate the cost of starting up and/or running the new practice by creating a financial pro forma. Then, based on the number of patients expected to join the practice and realistic ramp up period, you determine the pricing needed to be profitable.

You’ll first need to get a good handle on all fixed and variable monthly costs, which can be challenging for those starting up a new practice for the first time. It’s also essential to factor in a realistic monthly marketing budget and put a strong marketing campaign in place to: a) maximize the number of patients who transition with you, and; b) bring in enough new patients from the community to reach the practice goal.

On the income side, projecting monthly revenue is tricky because it’s hard to know what’s realistic for short- and long-term membership numbers. Let’s say you have a practice of 2000 active patients and convert 8-10% of them (typical percentages) to a DPC model, so perhaps 200 or so members initially join. Without the contribution of insurance-based revenue, if your fees are low, hundreds more members will still needed for a profitable business. While attracting the first 200 members may be doable, finding another 300 or 400 patients who don’t know you can be a daunting process. Your financial projections should accommodate this potential reality. The lower the price, the greater the number of members needed, so one needs to be realistic about whether or not a particular membership goal is attainable.

2. Competitive pricing

This approach is not based on practice costs, but rather physician supply and demand, and what the “going rate” is for similar services – as determined by market research of competitors in your service area. You may intentionally price higher for offering greater value. Or set fees lower in the hopes of being more attractive. Or match the pricing of similar practices. For example, where there are multiple MDVIP doctors in the area I’ve seen all nearby practices hold their pricing to the same level, even in an affluent market.

3. Value-based pricing

This pricing method is based on how much your customers are willing to pay. The first step is to assess the demographics (such as market size, affluence, purchasing behavior) and competitive landscape (who offers what and at what price). Then determine what the “perceived value” may be of your services; how is what you offer different, better, and of greater value? As an example, a practice with a combined primary care and Functional Medicine approach could easily be perceived as offering a greater value, for which you could justify charging significantly more.

In addition, the level of familiarity with and perception of DPC or concierge in the market can significantly affect perceived value. For instance, concierge medicine is much better known and accepted in parts of Florida, whereas in other markets, once the media shines a favorable spotlight on the DPC model, patients are primed and more likely to value what a DPC practice has to offer.

DPC physicians can also look to what patients have been readily willing to pay for concierge services (typically $150 – $250/month and up) and considering the added benefits of joining a DPC practice such as no co-pays or deductibles, and discounts on labs and imaging, and price accordingly.

Try not to let fear be the driver in determining your price. Many physicians feel the lower the price, the more patients will join. But it often doesn’t work that way. For any product or service, if the price is set too low, people question the quality and value. In fact, studies repeatedly show that people are even more willing to buy when prices are higher. Starbucks coffee, anyone?!

4. Copy Cat pricing

This is not recommended! While it can be tempting to model another practice’s pricing structure, what works very well for one practice will not necessarily work for another. There are many differentiating factors to consider such as: market forces; local competition; patient demographics; average patient ages and medical needs; your practice style; how many patients you want to see each day; and how much time you choose to spend with patients.

The Art of Pricing

So which is the right price-setting strategy to use? Cost-based? Competitive? Value-based?

The answer is all three, and it’s where the “art” of pricing comes in. When working with my clients, I use a combination of these strategies to create the best overall pricing strategy and outcomes – both for the practice and the members.

There’s actually one more consideration – and that is to incorporate your intuition. While winging-it is never a recommended way to run a business, it is important to “sit with” the pricing decisions as you make them. You can feel confident your fees reflect the value you intend to bring to your patients and know your business is better protected.

If you need help figuring out your pricing structure, please get in touch.